Best Tips About How To Reduce Debt Ratio

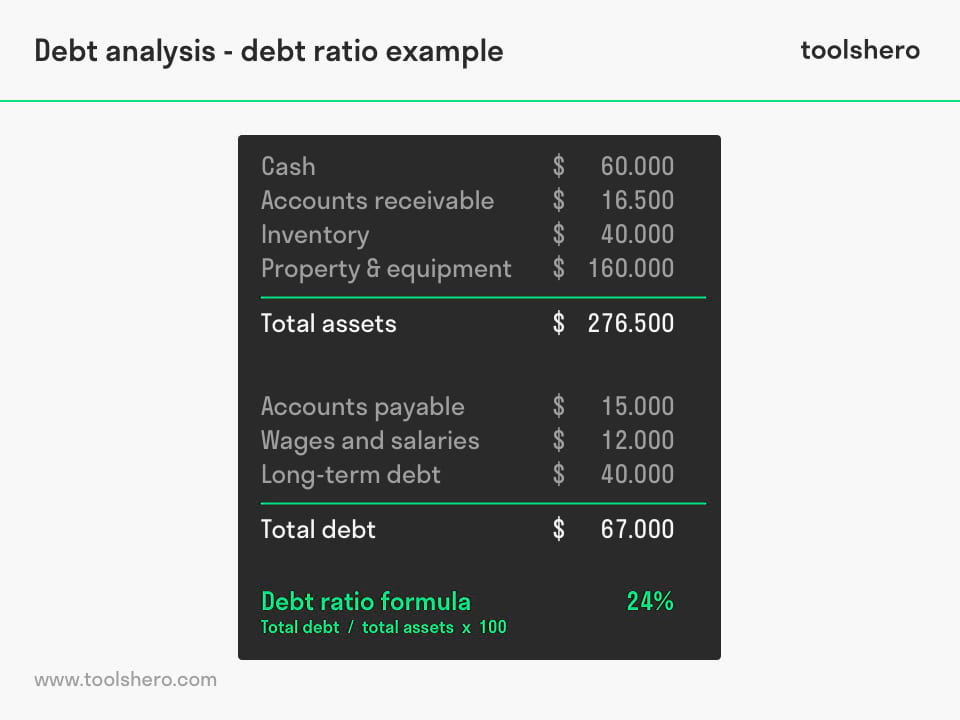

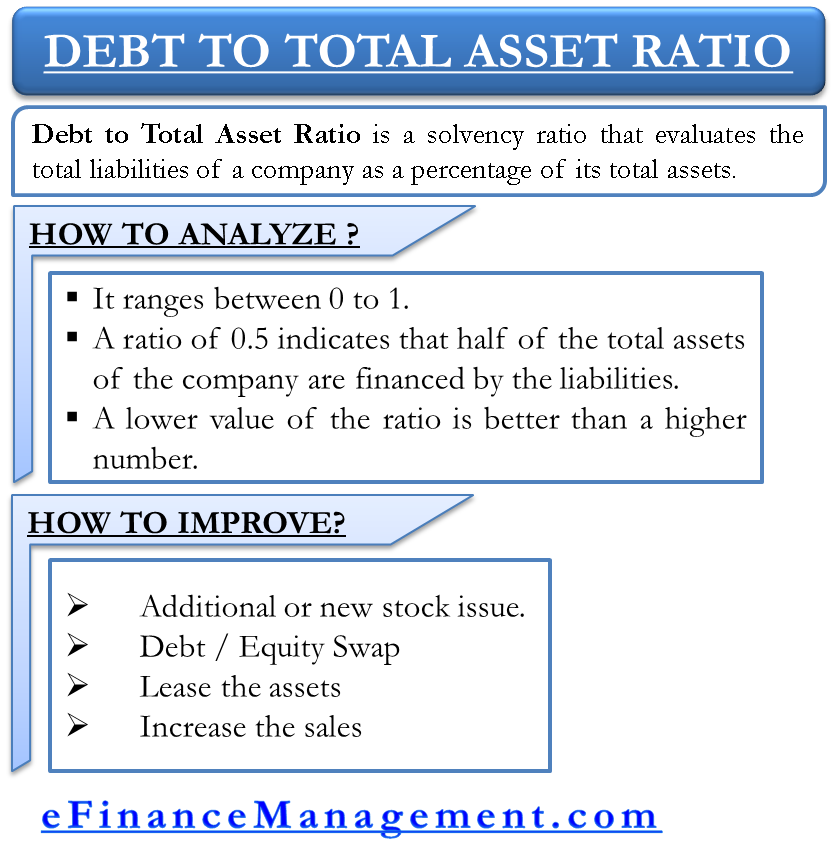

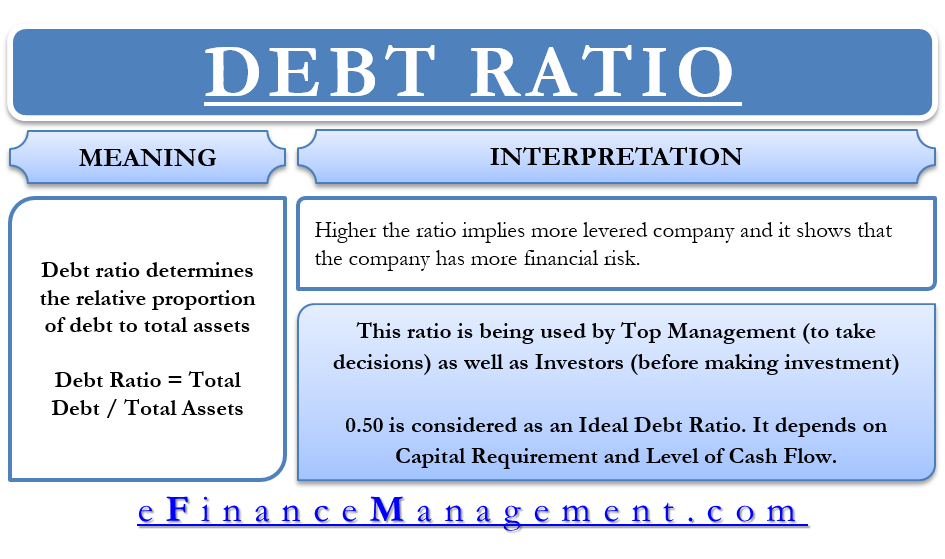

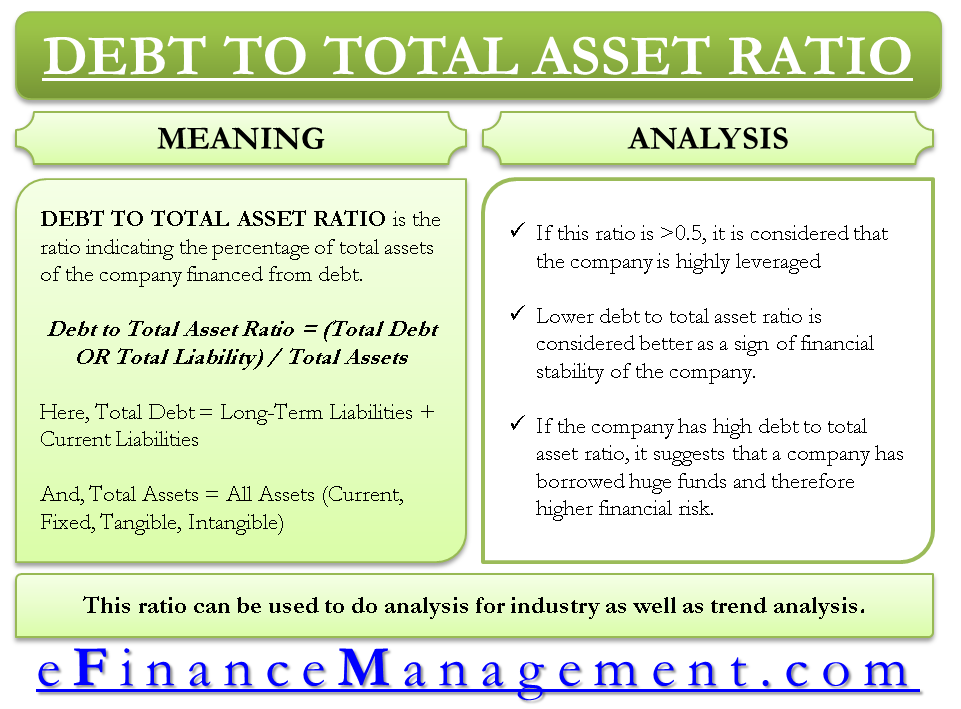

The debt reduction would, in turn, lower the debt to assets ratio.

How to reduce debt ratio. Determine what to pay each month. Gather all your records and write down the balances of all. On the debt side, only debts for which you still have nine or more months more of payments to make are included in the calculation of your dti.

Longer repayment terms have lower monthly payments than shorter repayment terms,. The debt avalanche method is an alternative to the debt snowball method. Track your debts more closely.

If you pay off credit cards to lower your. Basically, it consists of pushing interest rates to artificially low levels, in order to reduce borrowing costs: “instead of buying furniture when they’re offering 0%.

5 ways to lower dti 1. That could mean working some overtime, asking for a salary. Learn the benefits of consolidating your debt!

First, you can increase your income. Besides the debt avalanche and snowball methods, there’s another approach that might be more effective in lowering your dti. Using this strategy, you’d start by paying as much as possible toward the debt with the highest.

Make more money or pay off your debt. One of the biggest problems people have is just keeping track of all their debts. It's an indicator that you have a lot of debt relative to your debt capacity.

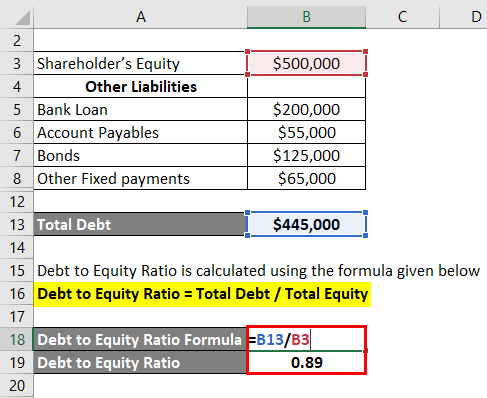

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png)

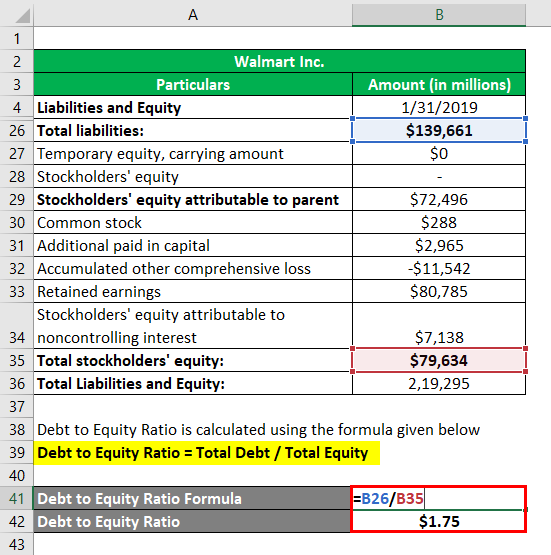

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)