Spectacular Tips About How To Buy Preferred Shares

Ad we’re all about helping you get more from your money.

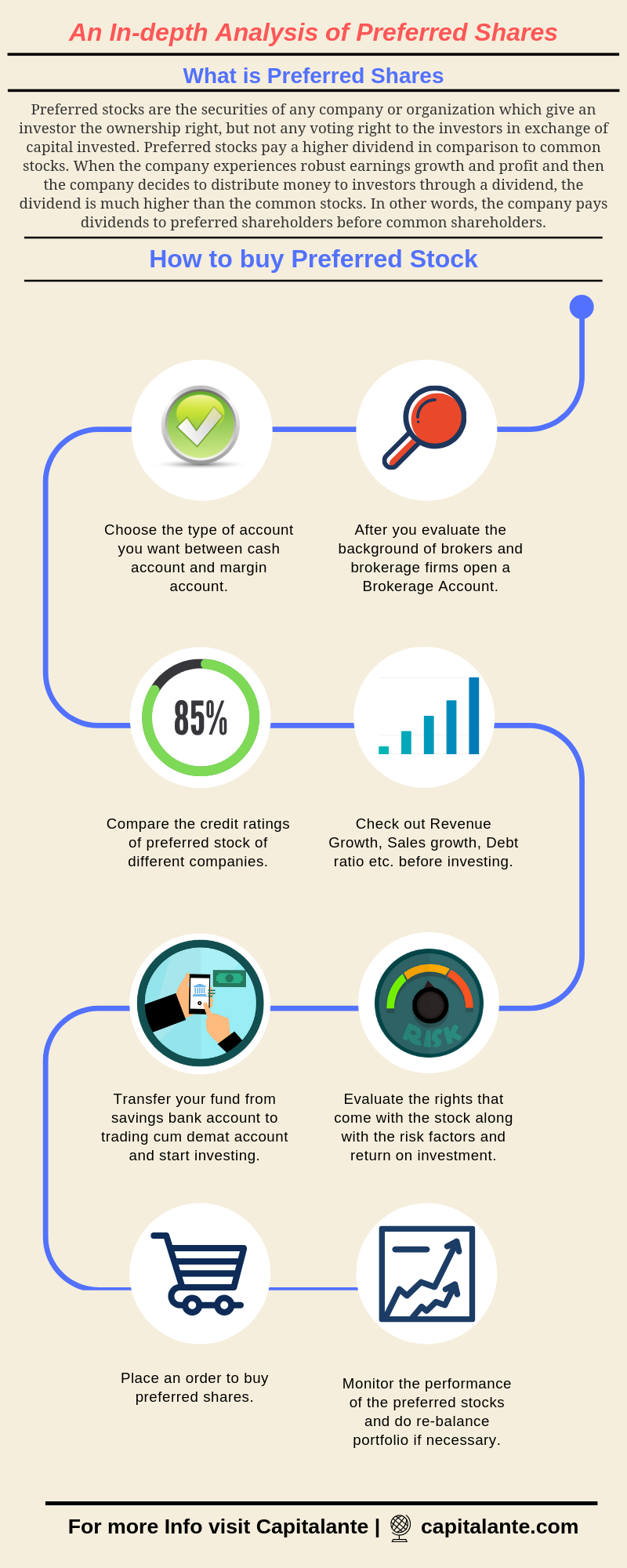

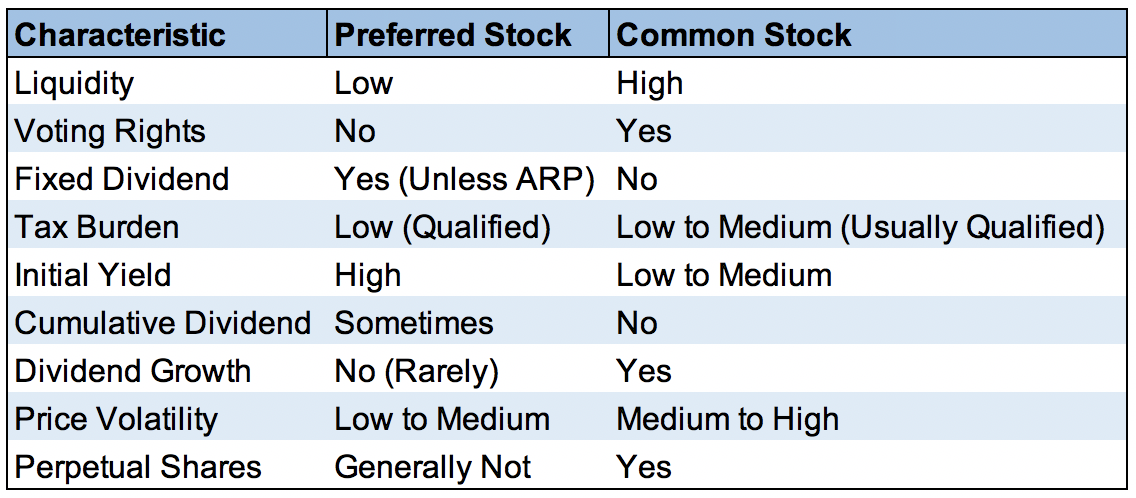

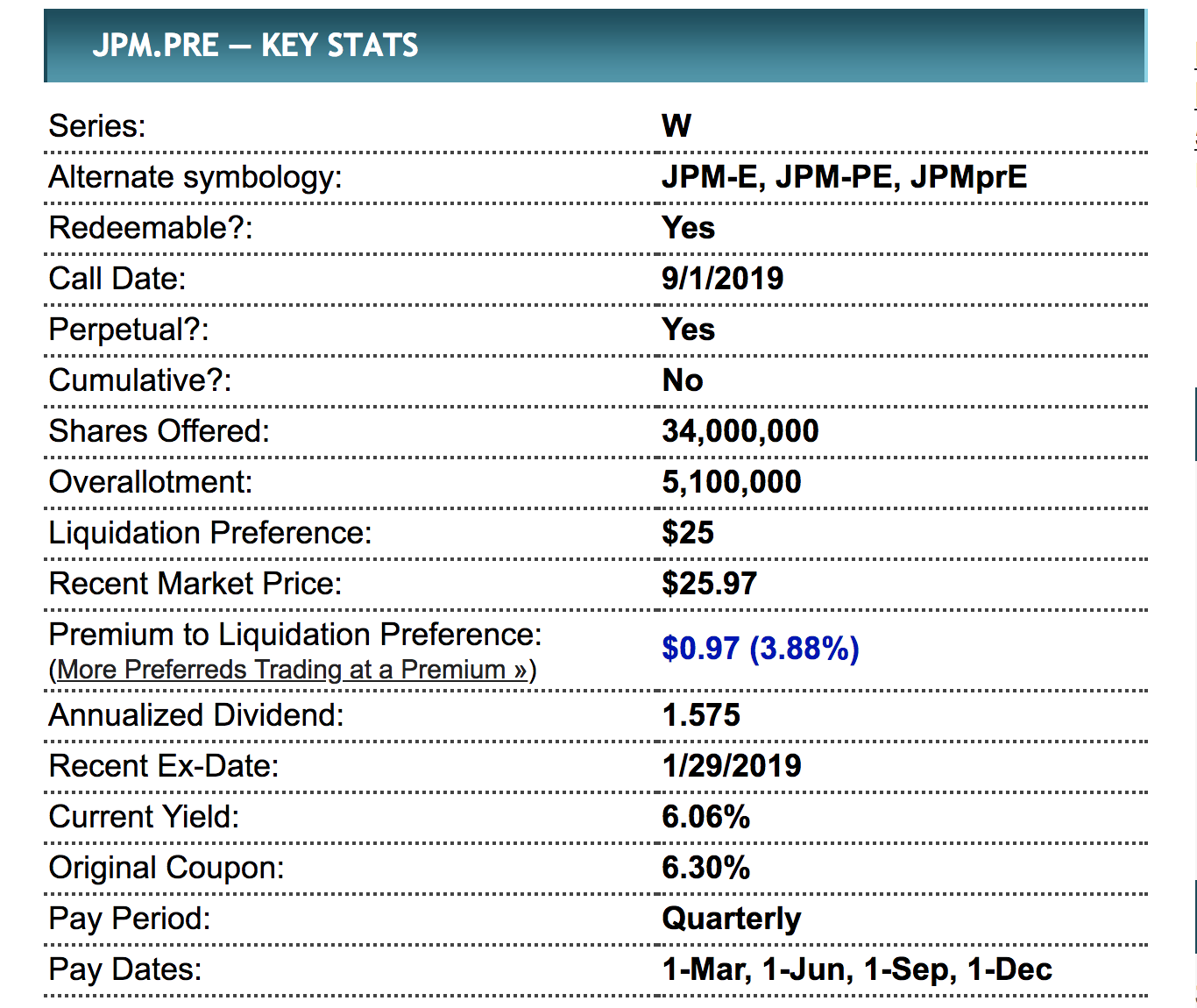

How to buy preferred shares. Our financial advisors offer a wealth of knowledge. Make sure you understand if the rate is floating or fixed and how much each preferred shares is worth in. Preferred stocks get preferential treatment over common.

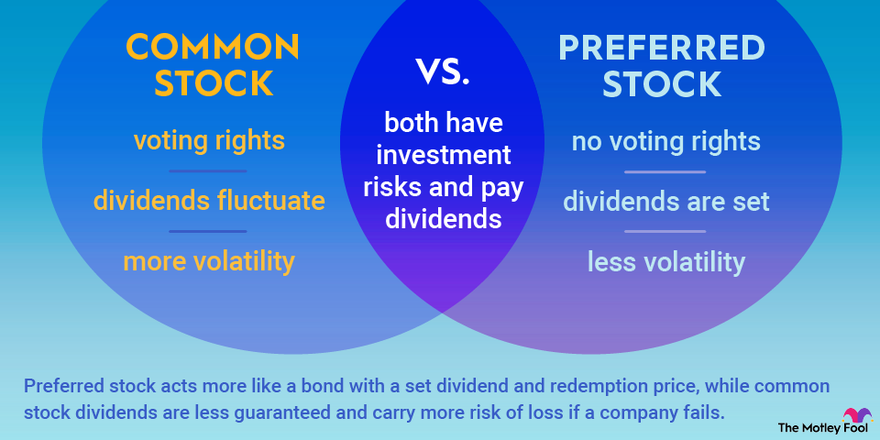

Both are equity in a company, but preferred stock typically pays a higher dividend. At&t's preferred shares are fairly safe investments for conservative investors. Ad ensure your investments align with your goals.

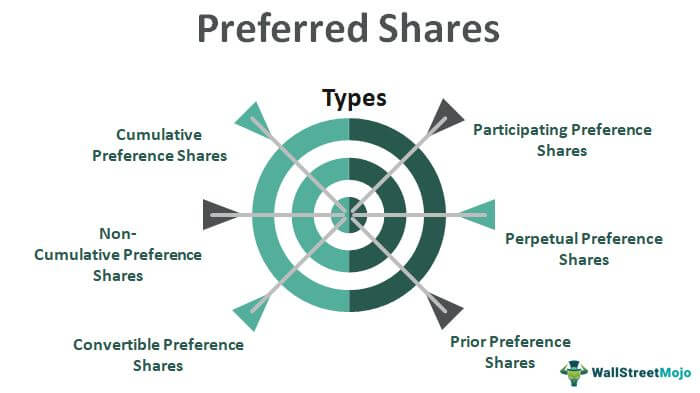

Ishares s&p/tsx canadian preferred share etf (cpd) the ishares s&p/tsx canadian preferred share etf mimics the performance of the s&p/tsx preferred share index. Preferred shares are a form of equity that makes up a company's capital stack. the capital stack is simply the priority by which debt and equity investors have claim over a company's assets. Some companies issue preferred stocks to raise cash.

For example, a share of preferred stock selling for $100 might pay an annual dividend of. If a corporation is unable to pay its dividends at any point in time, they may even be refunded to. The trend of buying list shares in foreign markets is increasing rapidly among indian.

However, i think most investors should either stick with at&t's common stock, which offers a. The company will pay $15.28 for its series h. You can buy preferred shares just as easily as you buy common stock.

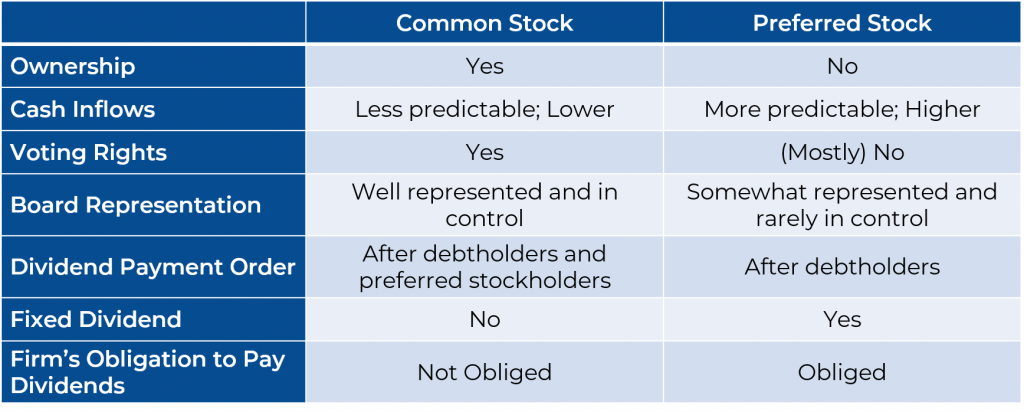

Preferred shares are different from common stock, the one most people are familiar with. When the interest rates go up, the value of preferred shares declines. Find a dedicated financial advisor now.

/PreferredStock-FINAL-c6dbf29d50d34121aa17f0b7ea771bad.png)

/PreferredStock-FINAL-c6dbf29d50d34121aa17f0b7ea771bad.png)

:max_bytes(150000):strip_icc():gifv()/Term-Definitions_preference-shares_FINAL-3318dcb09d1b43389aa88dfd6f79420f.png)